I was a newly minted finance manager assigned to a business unit that was unfamiliar to me (let’s call it ‘operations’, I’m being intentionally vague).

And we were running into a wall on a root cause analysis we’d been working on for weeks.

It should have been textbook - costs were up and it had to be 1 of our 6 typical drivers…

Except it wasn’t.

The 6 drivers weren’t adding up to the total. Something was missing.

I was self-conscious because I thought this was my inability to see something obvious. So we kept pressing business leaders…

Fast-forward a few more weeks and it came out that the unidentified gap was due to an operational data issue that was leading to $100M of cost leakage.

oh snap!

Our analysis had gotten picked up by corporate leadership and led to an internal review of the increased costs.

I’m not saying my team was perfect in this (we could have done more, faster)…

But we were the only ones who continued to press on the issue:

Operations leaders didn’t want us in their business

Business unit leaders made me think my analysis was bad

We stuck to the facts and finally got to the bottom of it.

This newsletter issue will teach you the process I used to drive over $100M in value for an organization with root cause analysis.

While your scale of impact might be different, it’s the same process.

Let’s jump in!

Thanks to our sponsors who keep the newsletter free!

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Want to be featured in front of over 10,000 finance leaders? Learn more here.

Know your business model

The same finance professionals who perform the best root cause analysis are the ones who know the business model best.

It’s why finance leaders hire talent from inside their industry.

Knowing your business model means you know the typical financial drivers (last week’s newsletter) for each financial account on your financial statements.

What causes new sales

What causes churn

What causes cost increases

etc.

When you know your drivers, you can quickly diagnose what is unexpected.

Which sets you up to…

Know what’s happening in the business

If there’s one thing I know for sure about business, it’s that they never stand still.

Metrics are shifting, strategy is evolving, leaders have different ideas.

Which means there are opportunities for unintended impacts to the business.

Here’s what that might look like:

A new sales strategy is driving sales to a new customer segment

That customer segment has a higher close rate and average order value (yay!)

But it takes a few months to realize they also have a higher propensity to call customer service (4x the rate of the typical customer)

While it’s best to anticipate impacts to a business before an initiative launches, it’s nearly impossible to keep up with a fast moving organization.

And now that you know your business model and know what’s happening in the business, you are best equipped to crush some root cause analysis…

What, why, so what

The holy trinity of analysis is 3 magical questions:

What happened?

Why did it happen?

So what? or What’s next?

And root cause analysis specifically addresses the ‘why’ behind the trend.

Back to my story in the intro… when we were evaluating the increase in cost and the 6 primary drivers, we started and ended with a 1-pager analysis that addressed ‘what’, ‘why’, and ‘so what’.

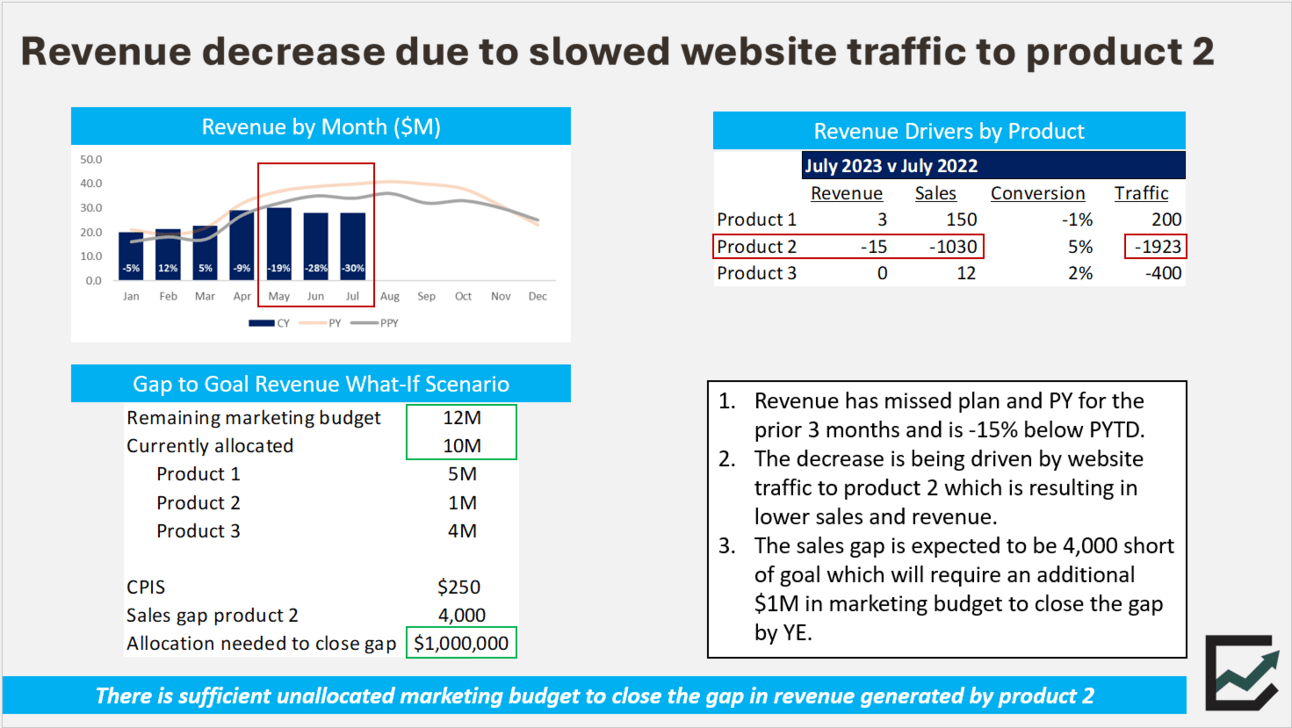

In my FP&A Flywheel course I break down exactly how to do this with a legit example (below). Check out the course here if you’re interesting in video instruction on how to do this.

Forcing yourself to condense everything onto 1 page means you have to stay focused on directly answering the questions.

My 1-pager example of What, Why, So What

Here’s the process:

Root cause analysis begins by anchoring to What Happened - which is actually just variance analysis. In the example above, revenue decreased. Keep it simple.

Then it moves into dissecting any potential drivers of that financial account to understand Why it Happened. In the example above we tested geographies, products, lead volume, close rates, and average revenue per sale. Clearly, we found that the driver was due to product 2 website traffic being down.

You can approach root cause analysis in 2 distinct ways:

Bottoms up: pull a bunch of data, organize it by all your segments/variables (geography, driver, product, customer type, etc.) and comb through you data looking for something that stands out and explains the variance.

Top down: work with key stakeholders to form hypotheses and test those hypotheses by pulling the specific data needed.

You’ll know you found the root cause of the issue when you find a single variable that is the most impacted.

Working directly with business leaders and simply asking them ‘what do you think is driving the revenue decrease?’ or leveraging Ai to come up with a list of ‘20 reasons revenue might have decreases for a B2B SaaS company’ are great ways to form and test hypotheses.

At the end of my weeks long analysis I had 40+ pages of appendix in my PowerPoint deck showing the dozens of analytical tests we’d done on every segment we could think of ( a mix of bottoms-up and top-down analysis) .

While your goal should be to consolidate down to a 1-pager that makes our jobs look easy, it’s perfectly normal to look into dozens of other ideas/segments/drivers that never lead anywhere.

In summary:

Root cause analysis is best done on the back of knowing your business model and what’s happening in the business.

Then use that info to dissect every potential driver you can think of.

Catalog it all, but distill the critical info into a single 1-pager for executive leadership.

How we can help:

Read our free content helping you drive business performance with finance best practices.

Check out our playbooks and courses teaching financial planning and analysis best practices for all kinds of businesses:

The FP&A Operating System (guide)

The Finance Manager Playbook (guide)

The FP&A Flywheel (course)

Get in front of 10,000+ finance leaders by sponsoring this newsletter.

Brett Hampson, Founder of Forecasting Performance